Company Summary

| FOUNDER CIFCO FUTURESReview Summary | |

| Founded | 2007-11-28 |

| Registered Country/Region | China |

| Regulation | Regulated |

| Market Instruments | Agricultural products, commodities, futures, and options |

| Simulation | ✅ |

| Trading Platform | Quick Period V2 and V3, Boyi Cloud, Wenhua WH6, etc. |

| Customer Support | Phone: 010-85881183 |

| Fax: 010-85881338 | |

| 400-880-2277 | |

| 95571 (4) | |

FOUNDER CIFCO FUTURES Information

Founder CIFCO Futures, briefly referred to as Founder CIFCO Futures, provides comprehensive services including futures trading, asset management, and wealth management. Founder CIFCO Futures offers a rich variety of trading tools, covering commodities, financial futures, options, and so on. Many trading platforms, such as Quick Period V2 and V3, based on CTP, can meet the needs of different traders.

Pros and Cons

| Pros | Cons |

| Regulated | Complex fee structure |

| Various trading instruments | High-risk nature of trading (futures trading) |

| Various trading platforms (CTP-based Quick Period V2 and V3 platforms) |

Is FOUNDER CIFCO FUTURES Legit?

Yes, Founder CIFCO Futures is a legitimate futures trading company. It is regulated by the China Financial Futures Exchange, and its license number is 0167.

What Can I Trade on FOUNDER CIFCO FUTURES?

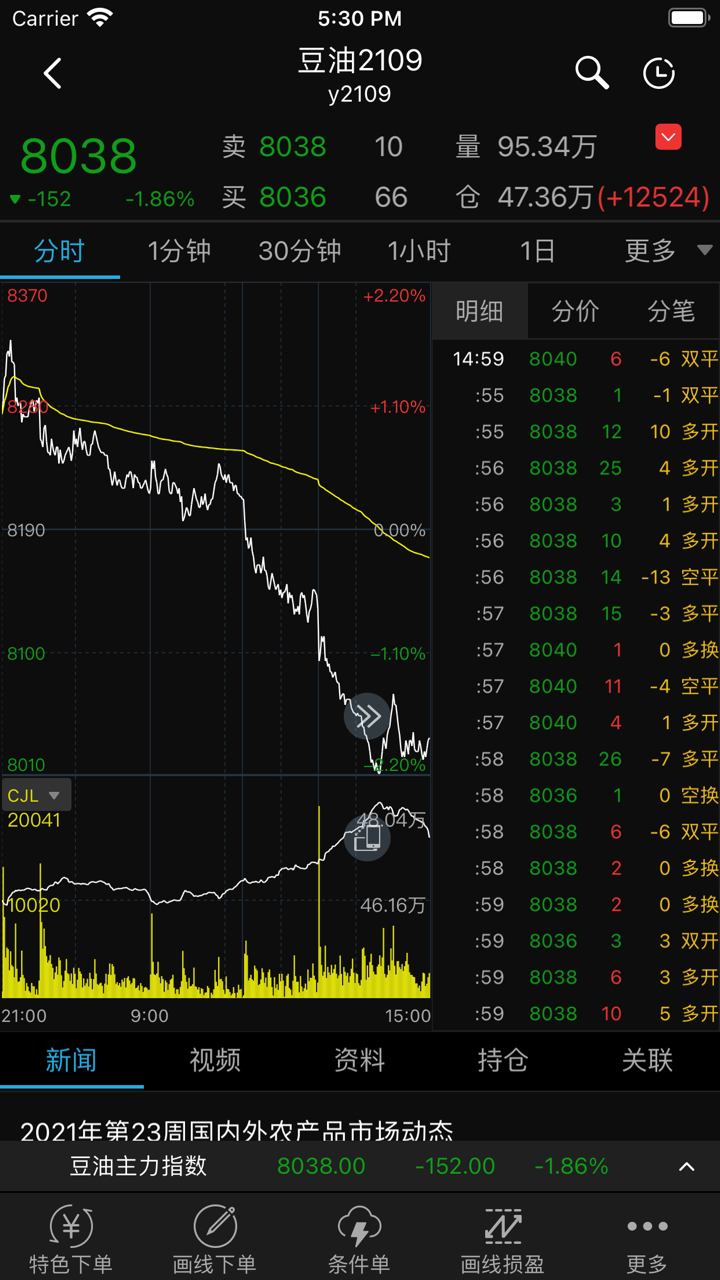

At Founder CIFCO Futures, investors can trade a variety of financial instruments. This includes commodities such as metals (e.g., gold, silver), energy products (e.g., crude oil), and agricultural products (e.g., wheat, soybeans). It also offers financial futures, such as stock index futures and interest rate futures. In addition, it provides options trading.

| Tradable Instruments | Supported |

| Agricultural products | ✔ |

| Commodities | ✔ |

| Futures | ✔ |

| Options | ✔ |

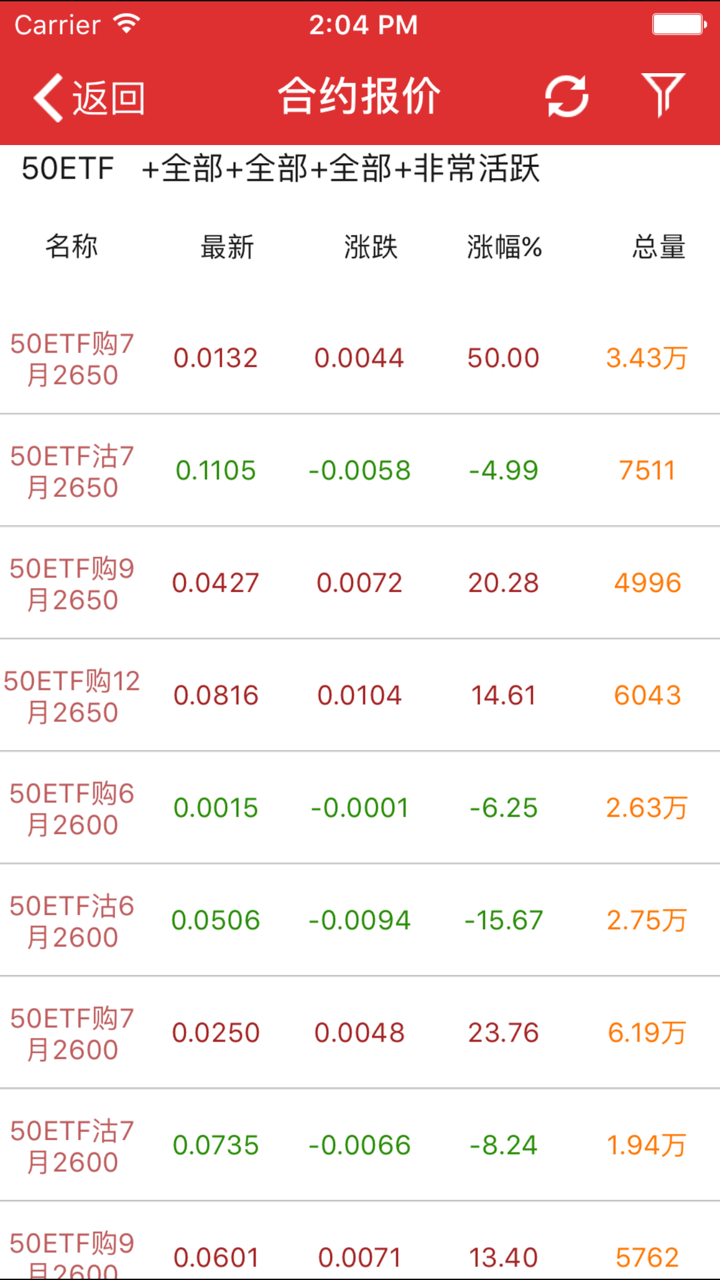

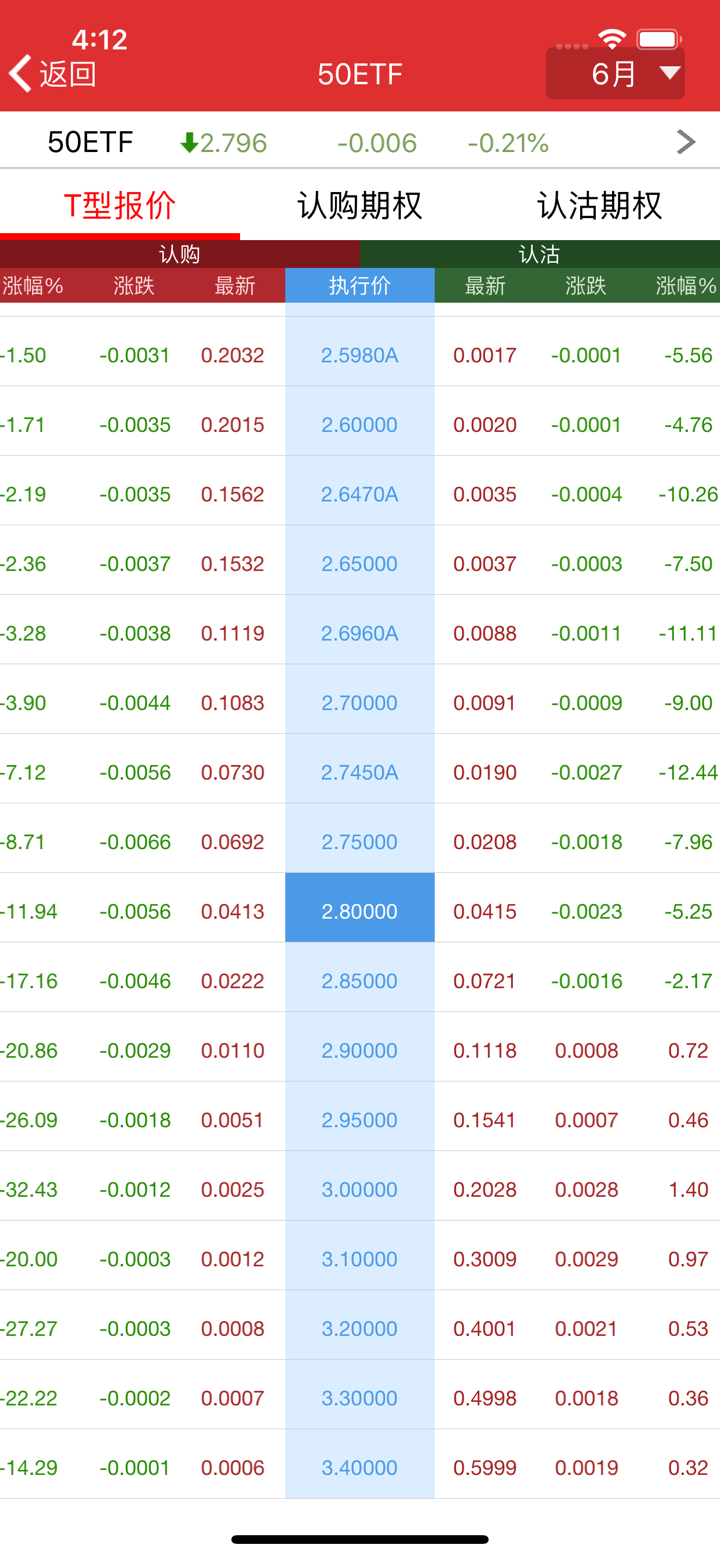

FOUNDER CIFCO FUTURES Fees

The fee structure of Founder CIFCO Futures varies according to the trading products. For example, in terms of stock options, the trading fee for ETFs on the Shanghai and Shenzhen Stock Exchanges is charged at 0.03% of the transaction amount. If the transaction amount is lower, the minimum fee is 5 yuan. The trading fee for ETF options is 10 yuan per contract.

Trading Platform

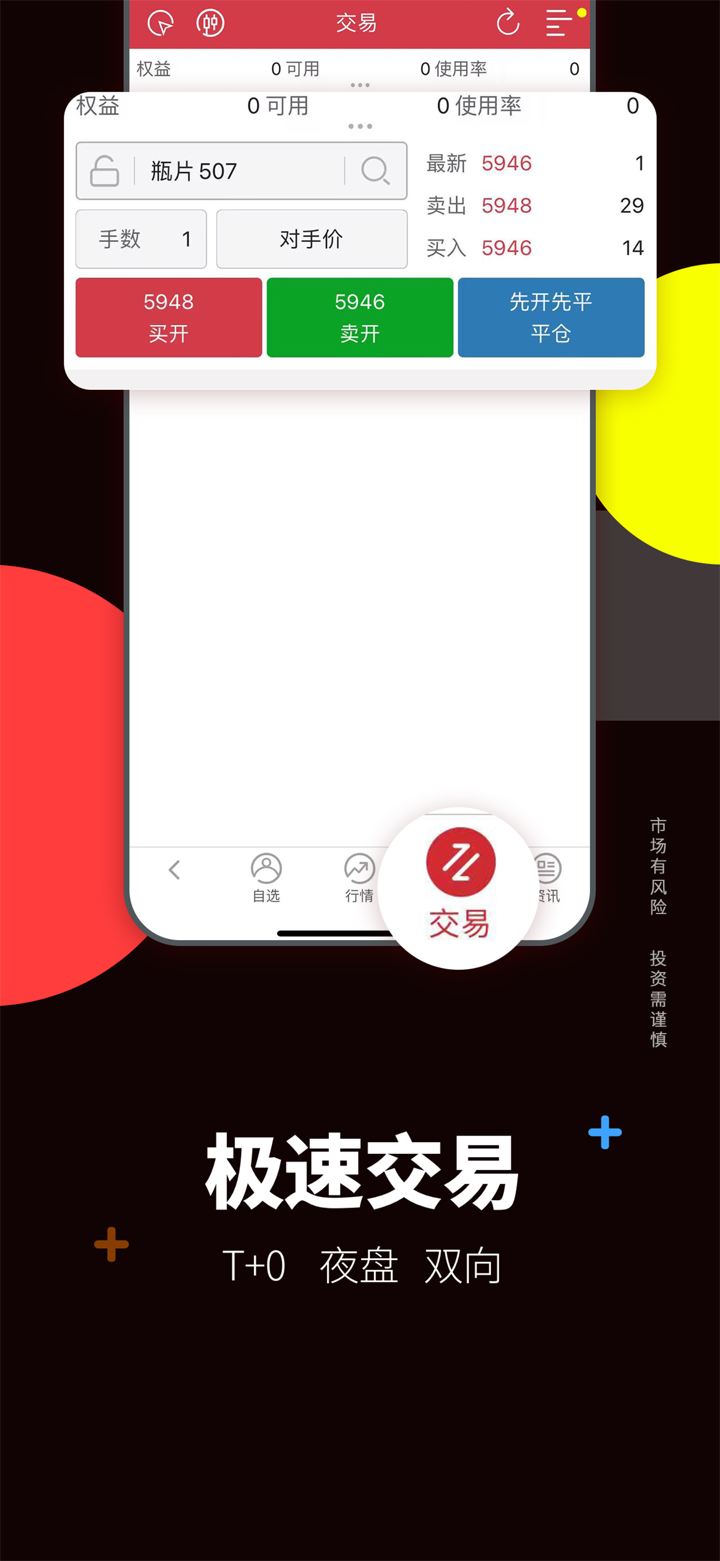

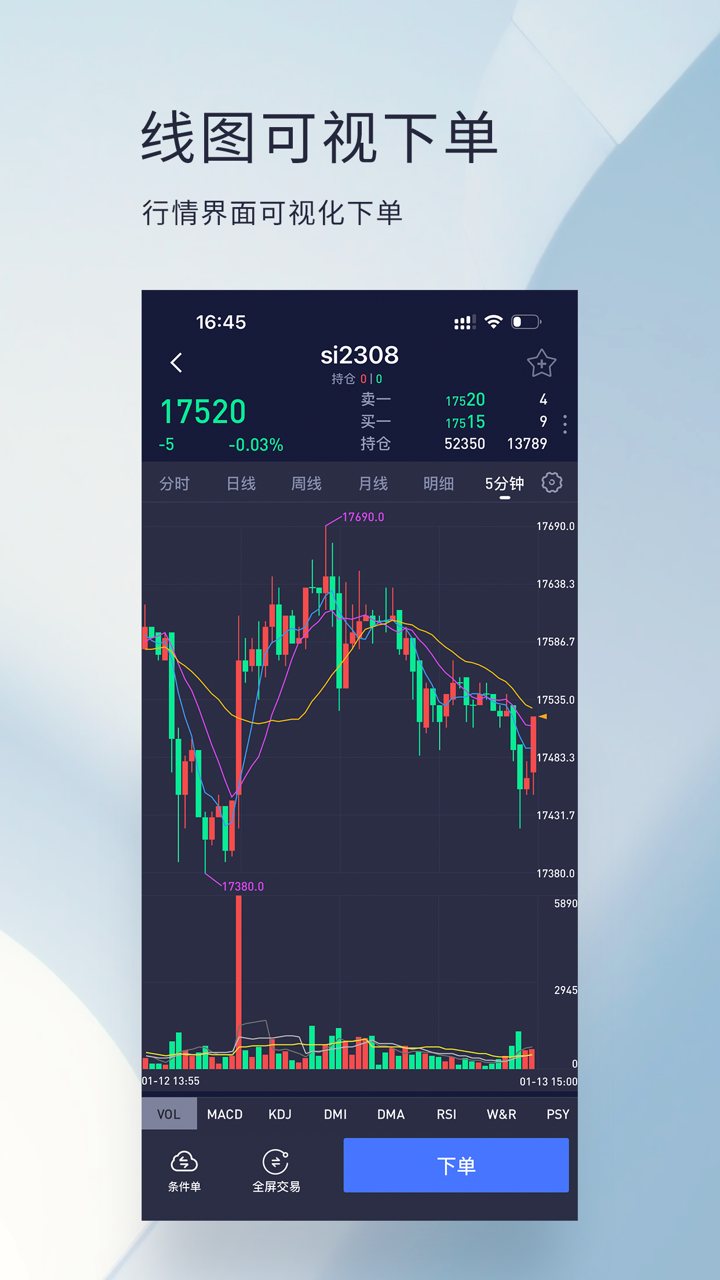

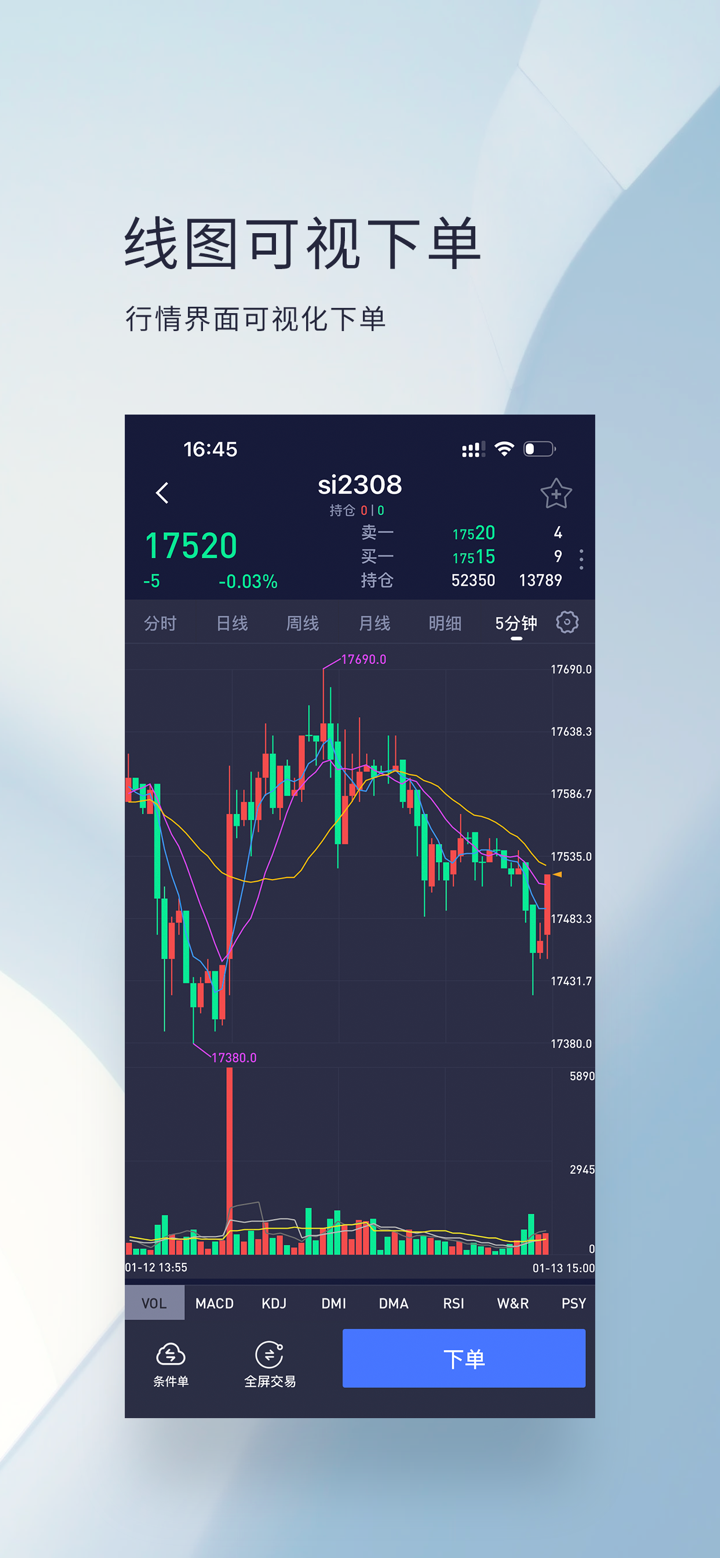

Founder CIFCO Futures provides a variety of trading platforms. Platforms based on CTP, such as Quick Period V2 and V3, are very popular among traders. Quick Period V2 offers different order placement methods for different types of traders, and it has functions such as custom arbitrage, position rolling, and large order splitting. Quick Period V3 supports multi-window and multi-screen settings and provides advanced order placement methods.

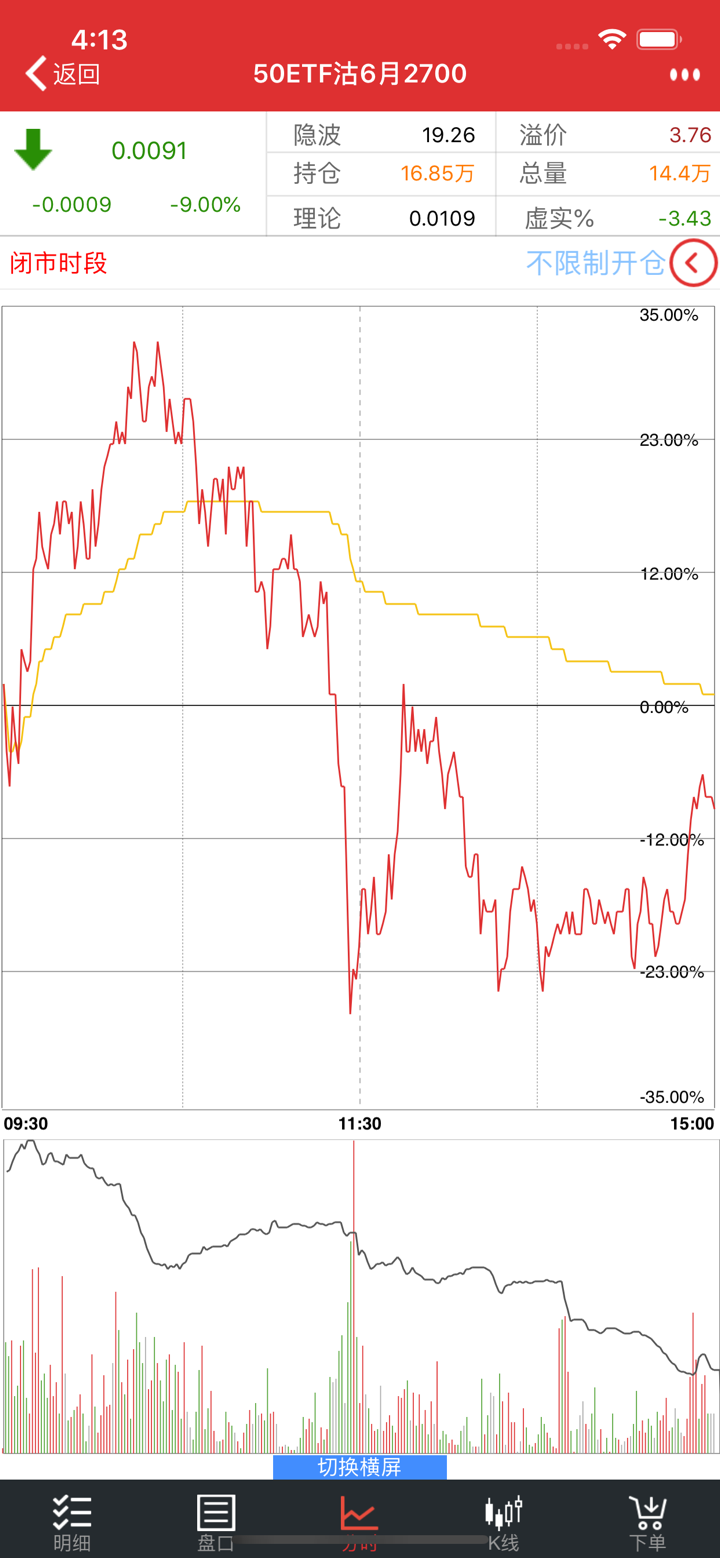

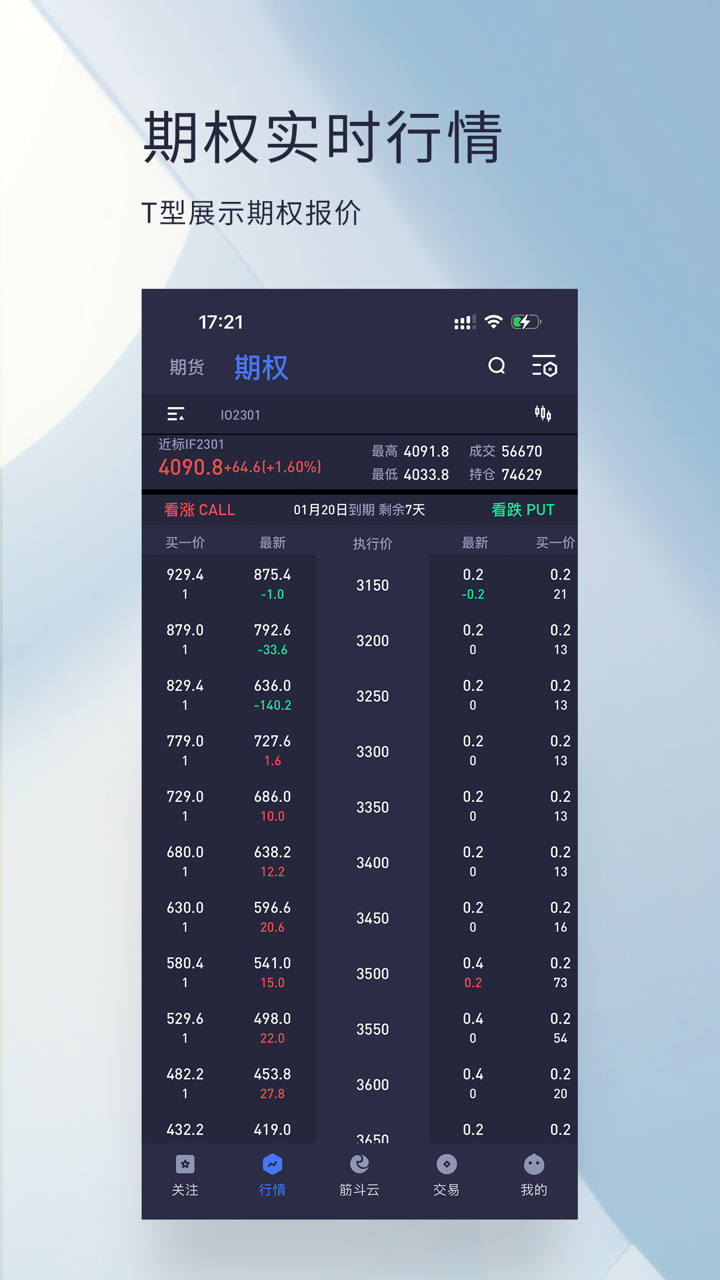

Other platforms, such as Boyi Cloud, support real-time commodity option trading and provide market analysis tools. Wenhua WH6, on the other hand, has functions such as three-key order placement and draw-line order placement.

Deposit and Withdrawal

There is no limit on the deposit amount for FOUNDER CIFCO FUTURES. Traders can deposit funds into their accounts through various methods, such as bank transfers.

The daily cumulative withdrawal limit for silver futures transfer is 5 million yuan. The maximum amount per transaction is 5 million yuan, and the maximum number of withdrawals per day is 5 times. The withdrawal time is from 9:05 to 15:30 on trading days.