公司简介

| Vita Markets评论摘要 | |

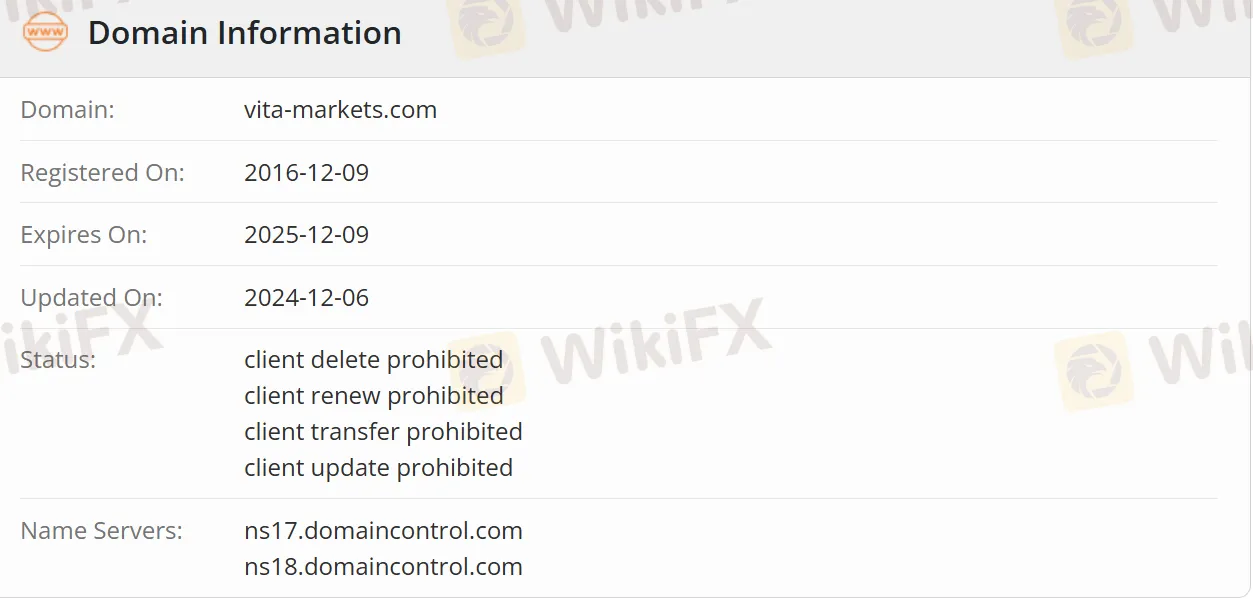

| 成立时间 | 2016-12-09 |

| 注册国家/地区 | 塞浦路斯 |

| 监管 | 受监管 |

| 客户支持 | +357 25311407/+357 25377104 |

| 电子邮件:info@vita-markets.com | |

| 电话:商务地址:3095,塞浦路斯,利马索尔,平达鲁14,法律地址:3020,塞浦路斯,利马索尔,艾奥卢和帕纳吉奥蒂·迪奥米杜斯9 | |

Vita Markets信息

VM Vita Markets为个人和公司客户提供投资服务。VM Vita Markets有限公司是一家塞浦路斯投资公司(CIF),受塞浦路斯证券交易委员会(CySEC)授权和监管,具有CIF许可证号373/19。

优点和缺点

| 优点 | 缺点 |

| 受监管 | 信息有限 |

| 提供投资服务 |

Vita Markets是否合法?

该公司持有CySEC颁发的CIF许可证(373/19),是一家合法注册的金融机构,符合欧盟反洗钱和投资者保护等监管要求。建议优先考虑运营稳定、信息透明的经纪商。如需进一步了解信息,您可以通过CySEC官方网站验证公司当前的监管状态。

Dam0nG

美国

非常好的应用程序,我刚刚开始投资。对我来说,该应用程序很容易导航。支持在交易所的工作时间内提供,但我猜他们承诺最终将提供 24/7 服务。最低存款额几乎没有限制,因此您只需 1 美元即可进行交易。这些条款是完全可以接受的。此外,甚至还有一些东西值得阅读,他们在这里发布了很多有趣的分析“我才刚刚开始投资。对我来说,该应用程序很容易导航。支持在交易所的工作时间内提供,但我猜他们承诺了这一点最终将提供 24/7。对最低存款几乎没有限制,所以你只需 1 美元就可以进行交易。条款是相当可以接受的。此外,甚至还有一些东西可以阅读,他们在这里发布了很多有趣的分析

好评

László

匈牙利

非常好的应用程序完全翻译成匈牙利语。我认为对于初学者投资者来说这是一个简单的工具。我最喜欢的是,当我用 80 美元开设账户后,他们给了我免费股票

好评

Byte_investor

俄罗斯

优秀的经纪人,拥有非常好的应用程序和友好的支持。没有那么多的投资想法,但所有这些都来自美国市场,这就是我一直在寻找的。

好评

Alvin4423

塞浦路斯

适合刚开始投资之旅的人的绝佳交易解决方案。简单快速的入职流程,轻松导航,访问表现最佳的股票,快速执行和合理的佣金。

好评