Company Summary

| OTKRITIE Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC |

| Services | Investment Advisory, Brokerage Services, Asset Management |

| Platforms | Open Key Platform, QUIK Platform |

| Customer Support | Tel: +357 25023870 |

| Email: infocyprus@otkritie-broker.com | |

OTKRITIE Information

Otkritie, registered in Cyprus, is an online trading platform regulated by CySEC. It offers Investment Advisory, Brokerage, and Asset Management services via its Open Key and QUIK platforms.

Pros and Cons

| Pros | Cons |

| Comprehensive services | No live chat support |

| Regulated by CySEC |

Is OTKRITIE Legit?

OTKRITIE holds a Market Maker (MM) license, regulated by the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, with license number 294/16.

| Regulated Authority | Current Status | Regulated Country | Licensed Entity | License Type | License No. |

| Cyprus Securities and Exchange Commission (CySEC) | Regulated | Cyprus | Otkritie Broker LTD | Market Maker (MM) | 294/16 |

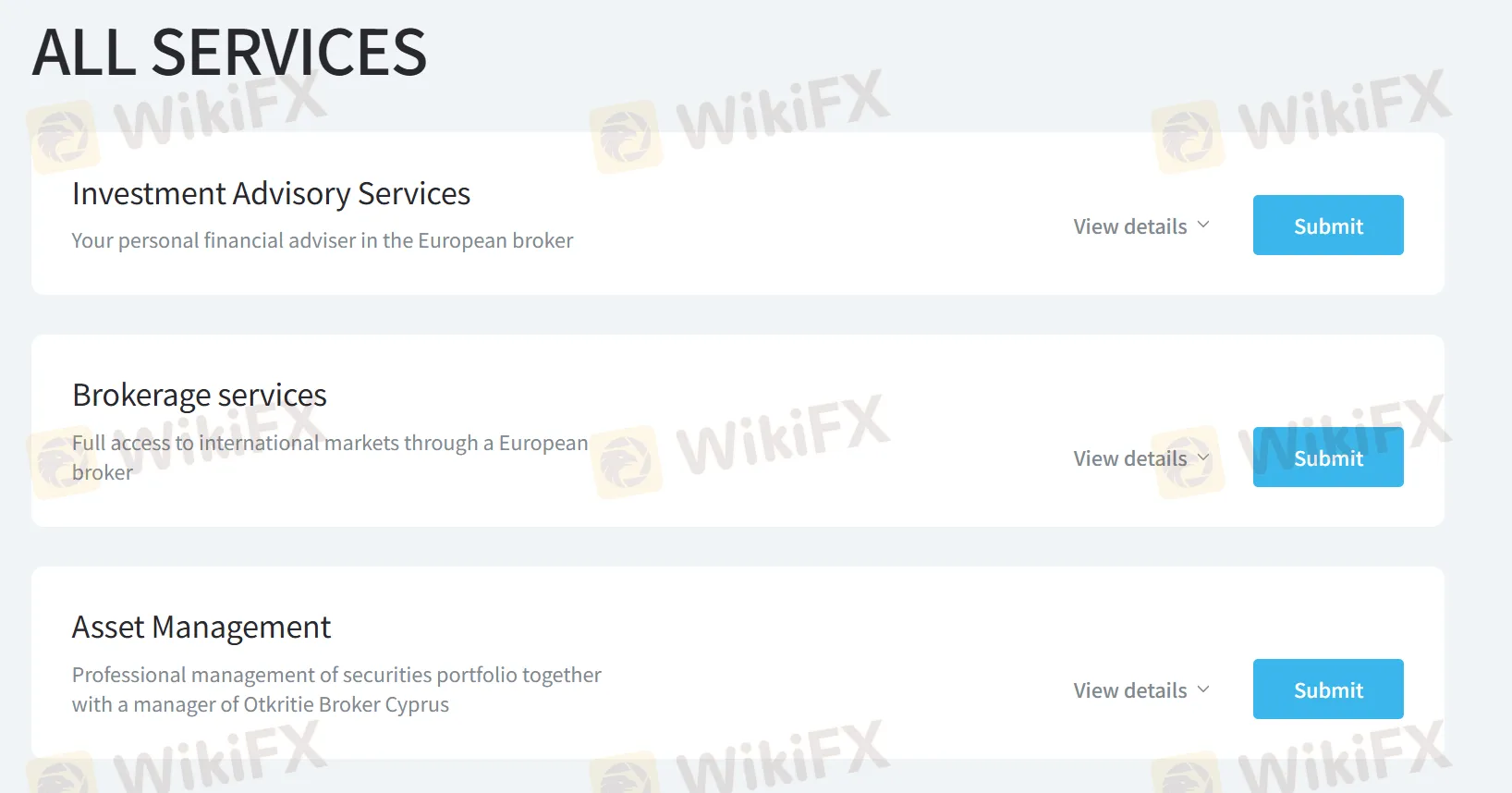

Services

OTKRITIE offers comprehensive financial services, including Investment Advisory for personalized financial guidance, Brokerage Services for global market access, and Asset Management for professional portfolio oversight—all through its European brokerage platform.

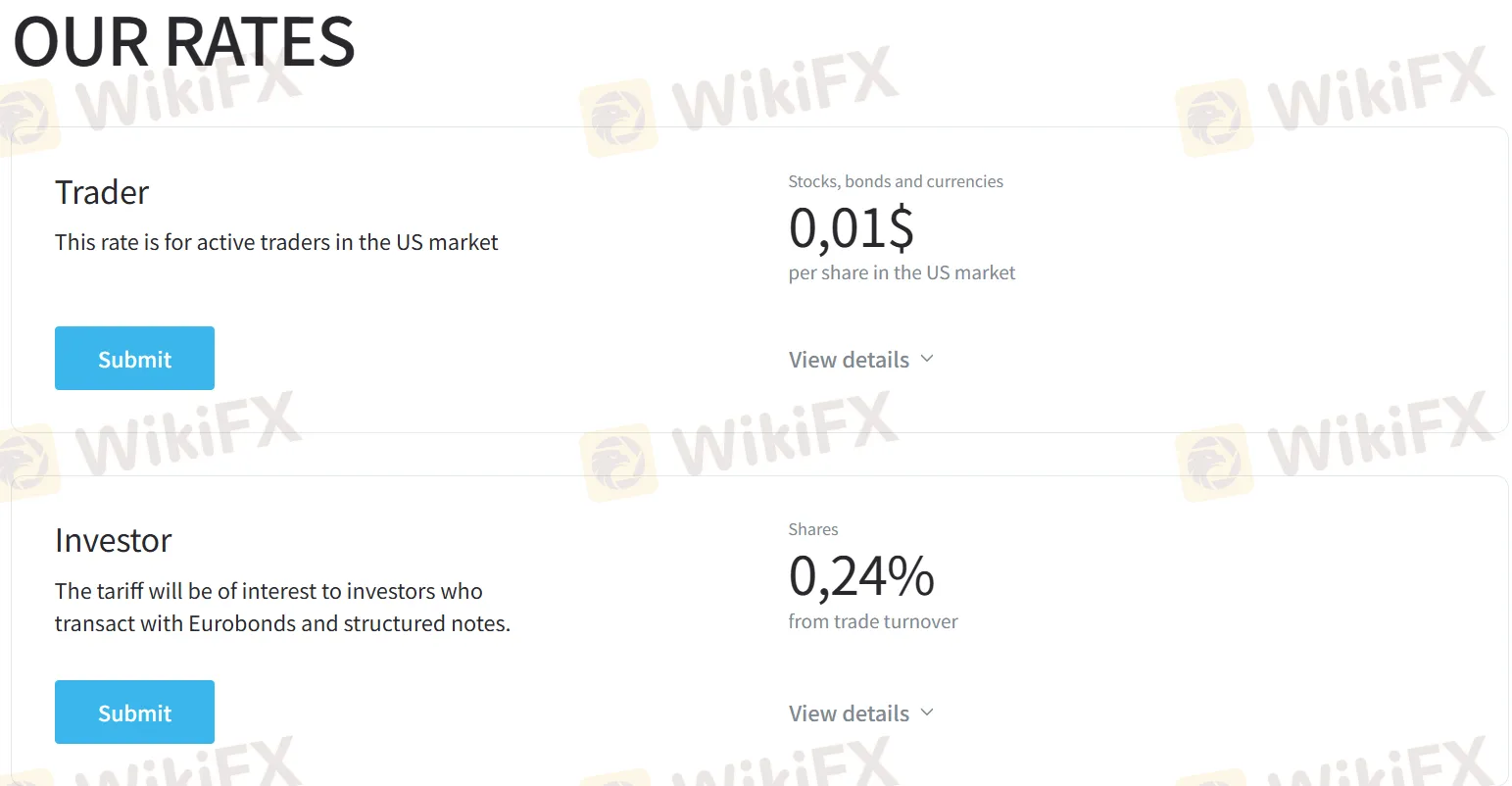

Rates

OTKRITIE offers two different competitive rate plans: Trader rate for US market participants (charged $0.01 per share), and Investor rate for Eurobond and structured note transactions (0.24% of trade turnover).

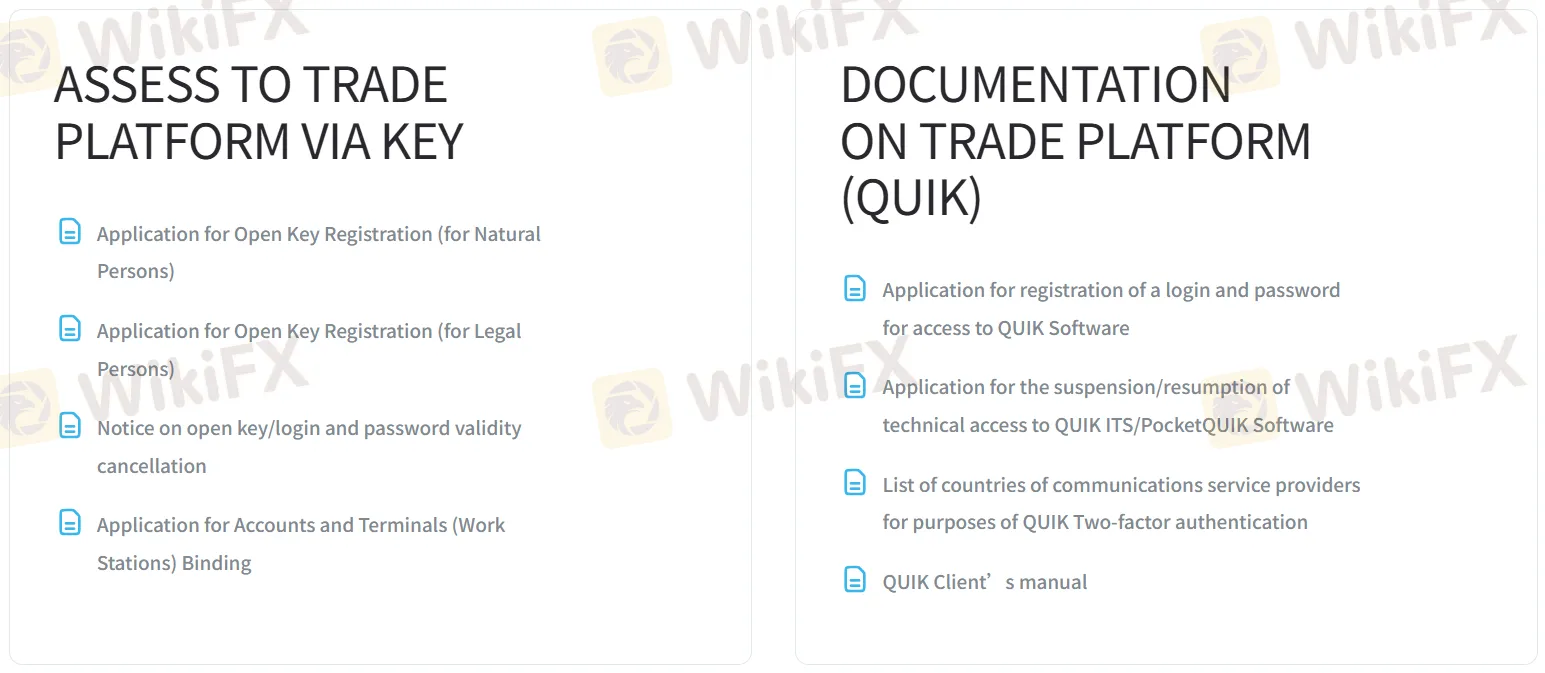

Platform

| Platform | Supported | Available Devices |

| Open Key Platform | ✔ | Desktop workstations |

| QUIK Platform | ✔ | Desktop (QUIK ITS), Mobile (PocketQUIK) |