Unternehmensprofil

| MTFX Überprüfungszusammenfassung | |

| Registriert am | 2016-03-04 |

| Registriertes Land/Region | Kanada |

| Regulierung | Unreguliert |

| Dienstleistungen | Währungsumtausch, grenzüberschreitende Zahlungen, Risikoabsicherung |

| Handelsplattform | MTFX (iOS und Android Apps) |

| Kundenbetreuung | Facebook, Twitter, Instagram |

MTFX Information

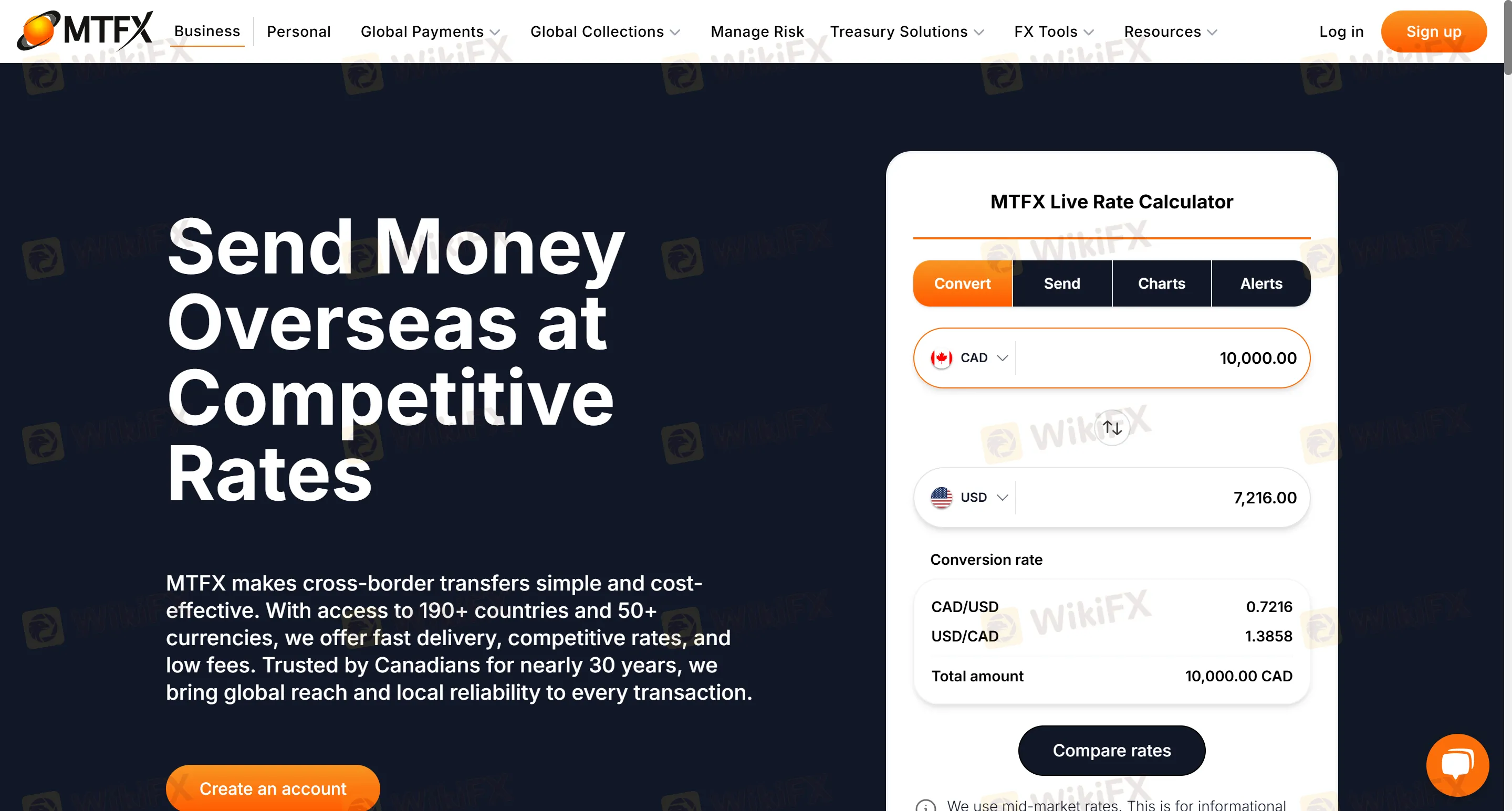

MTFX ist eine etablierte Plattform, die sich auf grenzüberschreitende Zahlungen spezialisiert hat und den Transfer von über 50 Währungen in über 190 Länder unterstützt. Es bietet persönliche und geschäftliche grenzüberschreitende Transfers, E-Commerce-Fondsammlung, Transfers großer Beträge (wie der Kauf von Immobilien im Ausland und der Erwerb von Luxusgütern), das Management von Multiwährungskonten und die Absicherung von Währungsrisiken. Es eignet sich für Benutzer, die häufige grenzüberschreitende Transfers benötigen und Wert auf Wechselkurskosten und die Sicherheit von Fonds legen, insbesondere bei Zahlungen großer Beträge und in Unternehmensszenarien.

Vor- und Nachteile

| Vorteile | Nachteile |

| 4% Wechselkurs | Unreguliert |

| 24/7 Zugang zum Online-Portal | Beschränkungen bei Währungspaaren (Schwerpunkt auf Hauptwährungen) |

| Abdeckung mehrerer Szenarien | Unklare Gebühreninformationen |

MTFX Legitim?

MTFX ist nicht reguliert, obwohl MTFX angibt, von FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) reguliert zu werden. Dieser Broker hat regulatorische Probleme, und es wird empfohlen, dass Trader die Auswahl regulierter Broker priorisieren.

Welche Dienstleistungen bietet MTFX an?

MTFX bietet hauptsächlich grenzüberschreitende Fondsüberweisungen und Devisendienstleistungen an, nicht jedoch traditionelle Finanzderivat-Handelsplattformen. Zu den Dienstleistungen gehören:

Währungsumtausch: Echtzeitumrechnung von über 50 Währungen, wie gängige Währungspaare wie CAD/USD und EUR/GBP.

Grenzüberschreitende Zahlungen: Persönliche Überweisungen (Studiengebühren, Lebenshaltungskosten, Hauskaufmittel) und Unternehmenszahlungen (Lieferantensiedlungen, Lohnabrechnung, E-Commerce-Sammlungen).

Risikoabsicherung: Festlegung von Wechselkursen und individuelle Absicherungsstrategien, geeignet für internationale Handels- und Investitionsszenarien.

Kontotyp

MTFX bietet zwei Arten von Konten an. Persönliche Konten eignen sich für individuelle grenzüberschreitende Transfers, internationale Studiengebührenzahlungen und regelmäßige Überweisungen (wie Miete und Rente), während Geschäftskonten für Unternehmensgrenzüberschreitende Zahlungen, Lieferkettenabwicklungen, Multiwährungsfondverwaltung und die Integration von E-Commerce-Plattformen (wie Amazon und eBay) konzipiert sind.

Handelsplattform

Das Online-Portal unterstützt rund um die Uhr mobile Anwendungen, einschließlich iOS- und Android-Apps.

Ein- und Auszahlung

Die Gelder werden direkt auf das Bankkonto des Zahlungsempfängers eingezahlt. Bei Unternehmensüberweisungen treffen die Gelder innerhalb von 24-48 Stunden ein (Eilüberweisungen am selben Tag haben Vorrang). Die meisten persönlichen Überweisungen werden am selben Tag oder am nächsten Arbeitstag abgeschlossen.