Şirket özeti

| MTFX İnceleme Özeti | |

| Kayıt Tarihi | 2016-03-04 |

| Kayıtlı Ülke/Bölge | Kanada |

| Düzenleme | Düzenlenmemiş |

| Hizmetler | Döviz Alım Satımı, Sınır Ötesi Ödemeler, Risk Korunması |

| İşlem Platformu | MTFX (iOS ve Android uygulamaları) |

| Müşteri Desteği | Facebook, Twitter, Instagram |

MTFX Bilgiler

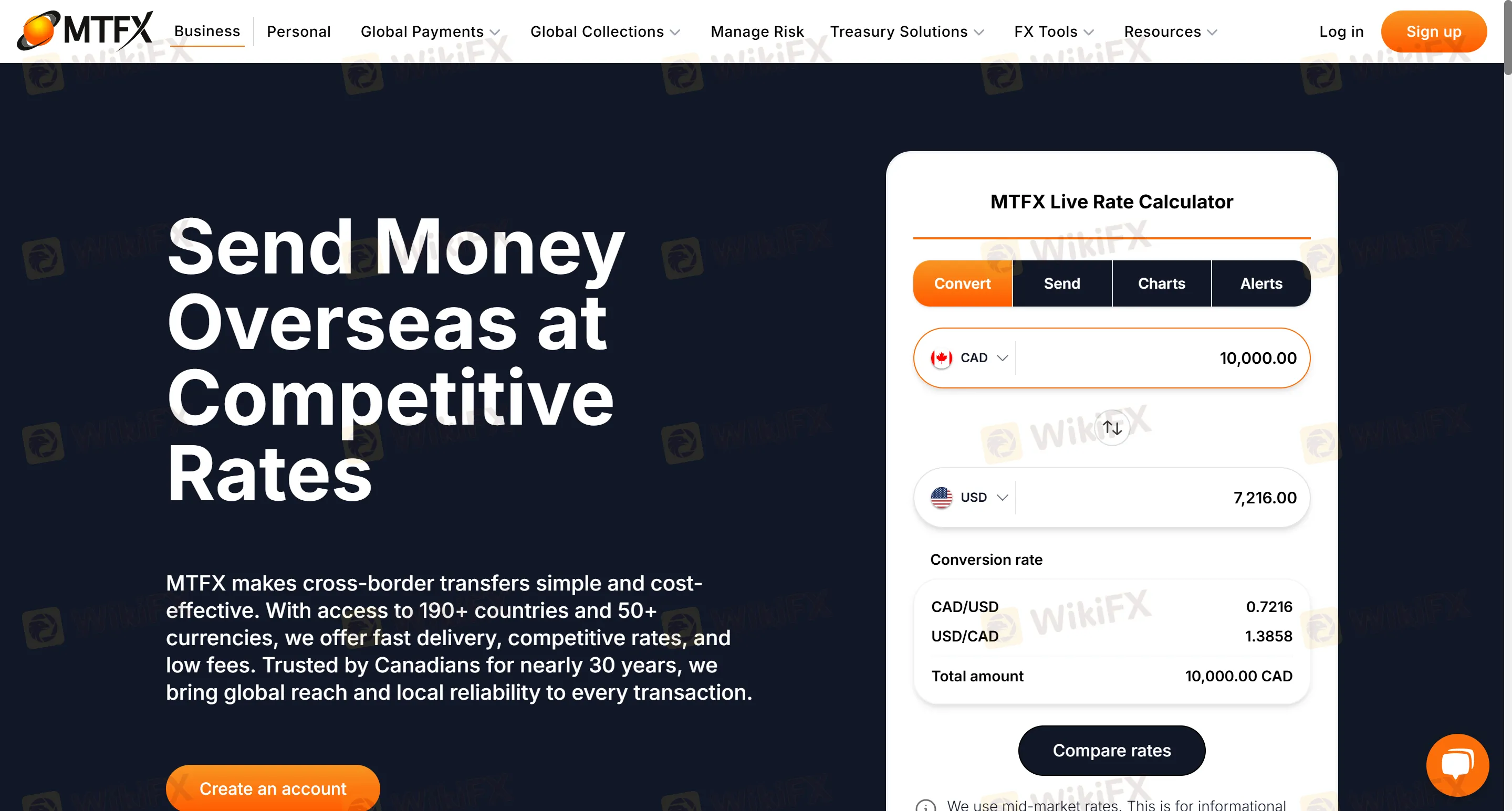

MTFX , 190'dan fazla ülkeye 50'den fazla para birimini transfer etmeyi destekleyen sınır ötesi ödemelerde uzmanlaşmış kurulmuş bir platformdur. Kişisel ve kurumsal sınır ötesi transferler, e-ticaret fon toplama, büyük tutarlı fon transferleri (örneğin yurtdışı gayrimenkul alımları ve lüks eşya edinimleri), çoklu para birimi hesabı yönetimi ve döviz risk koruması sunmaktadır. Sık sık sınır ötesi transferlere ihtiyaç duyan ve özellikle büyük tutarlı ödemeler ve kurumsal senaryolarda döviz kuru maliyetlerine ve fon güvenliğine önem veren kullanıcılar için uygundur.

Artıları ve Eksileri

| Artılar | Eksiler |

| 4% döviz kuru | Düzenlenmemiş |

| Online portalın 7/24 erişimi | Para birimi çiftlerinde sınırlamalar (önemli para birimlerine odaklanma) |

| Çoklu senaryo kapsamı | Belirsiz ücret bilgileri |

MTFX Güvenilir mi?

MTFX düzenlenmemiştir, hatta MTFX Kanada Finansal İşlemler ve Raporlar Analiz Merkezi (FINTRAC) tarafından düzenlendiğini iddia etse de. Bu aracı kurumun düzenleme sorunları bulunmakta olup, tüccarların düzenlenmiş aracı kurumları tercih etmeleri önerilmektedir.

MTFX Hangi Hizmetleri Sunuyor?

MTFX öncelikle sınır ötesi fon transferleri ve döviz hizmetleri sunmaktadır, geleneksel finansal türev işlem platformları değil. Hizmetler şunları içerir:

Döviz Alım Satımı: CAD/USD ve EUR/GBP gibi ana para birimi çiftleri gibi 50'den fazla para biriminin anlık dönüşümü.

Sınır Ötesi Ödemeler: Kişisel havaleler (öğrenim ücretleri, yaşam giderleri, ev alım fonları) ve kurumsal ödemeler (tedarikçi uzlaşmaları, maaş bordroları, e-ticaret tahsilatları).

Risk Korunması: Döviz kurlarını sabitleme ve özelleştirilmiş risk koruma stratejileri, uluslararası ticaret ve yatırım senaryoları için uygun.

Hesap Türü

MTFX iki tür hesap sunmaktadır. Kişisel hesaplar bireysel sınır ötesi transferler, uluslararası öğrenim ödemeleri ve düzenli havaleler (kira ve emeklilik gibi) için uygunken, iş hesapları kurumsal sınır ötesi ödemeler, tedarik zinciri uzlaşmaları, çoklu para birimi fon yönetimi ve Amazon ve eBay gibi e-ticaret platformu entegrasyonu için tasarlanmıştır.

İşlem Platformu

Online portal, iOS ve Android uygulamaları da dahil olmak üzere 7/24 mobil uygulamaları desteklemektedir.

Para Yatırma ve Çekme

Fonlar doğrudan alıcının banka hesabına yatırılır. Kurumsal transferler için, fonlar 24-48 saat içinde ulaşır (aynı gün tel transferleri önceliklidir). Çoğu kişisel transfer aynı gün veya ertesi iş gününde tamamlanır.