Buod ng kumpanya

| MTFX Buod ng Pagsusuri | |

| Nakarehistro Noong | 2016-03-04 |

| Nakarehistrong Bansa/Rehiyon | Canada |

| Regulasyon | Hindi Regulado |

| Mga Serbisyo | Palitan ng Pera, Pagbabayad sa Pagitan ng mga Bansa, Paghedging sa Panganib |

| Platform ng Paggagalaw | MTFX (iOS at Android apps) |

| Suporta sa Customer | Facebook, Twitter, Instagram |

{2201501537>Iba't Ibang Impormasyon

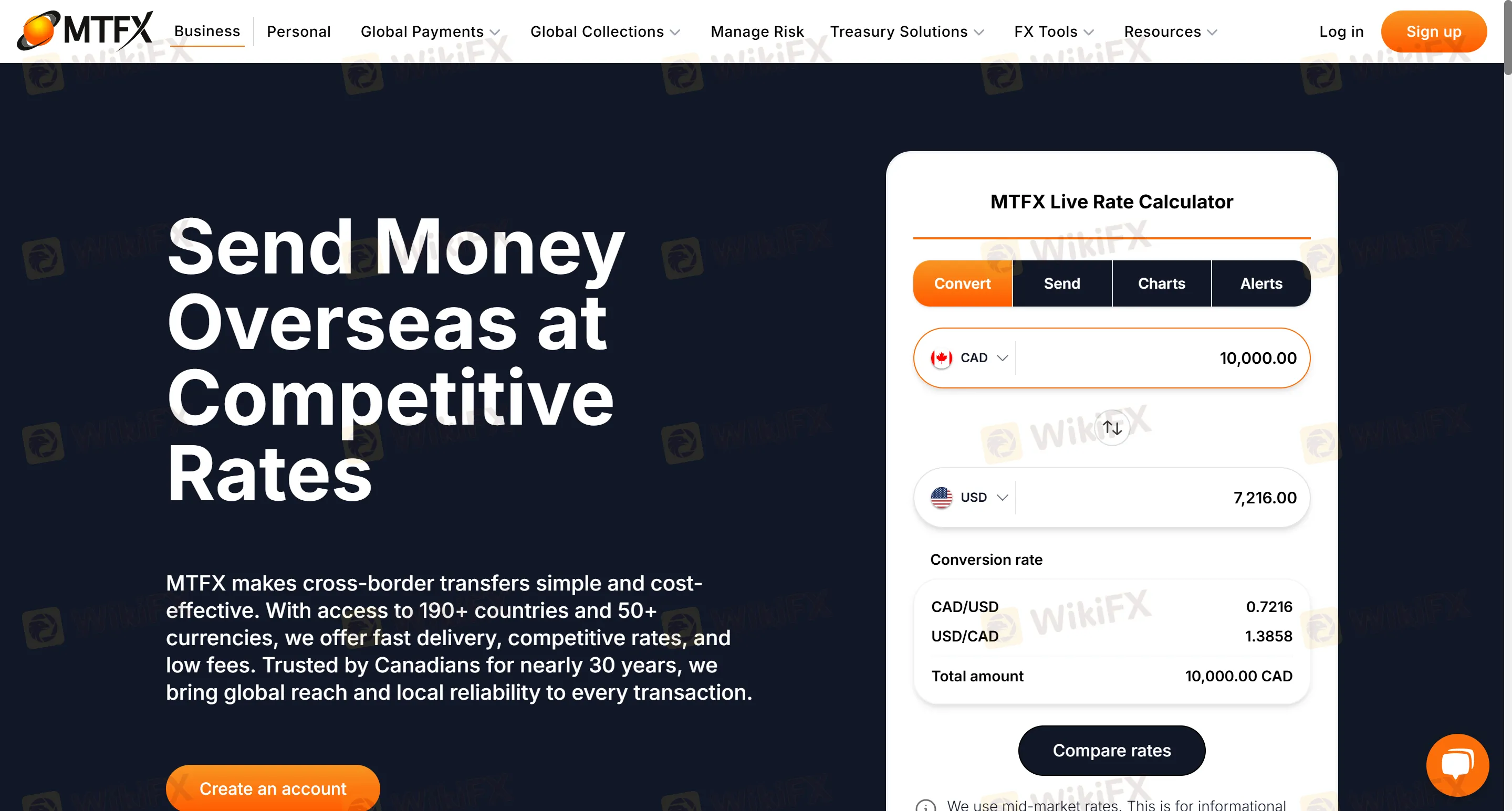

MTFX ay isang itinatag na plataporma na nagspecialize sa pagbabayad sa pagitan ng mga bansa, sumusuporta sa paglipat ng 50+ mga uri ng pera patungo sa higit sa 190 na bansa. Nag-aalok ito ng personal at korporasyon na paglipat ng pera sa pagitan ng mga bansa, koleksyon ng pondo para sa e-commerce, paglipat ng malalaking halaga ng pondo (tulad ng pagbili ng property sa ibang bansa at pagbili ng mamahaling mga bagay), pamamahala ng account na may iba't ibang uri ng pera, at paghahedging sa panganib ng pera. Angkop ito sa mga gumagamit na nangangailangan ng madalas na paglipat ng pera sa pagitan ng mga bansa at nagbibigay halaga sa mga gastos sa palitan ng pera at seguridad ng pondo, lalo na sa mga malalaking halaga ng pagbabayad at korporasyon.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| 4% rate ng palitan ng pera | Hindi Regulado |

| 24/7 access sa online portal | Mga limitasyon sa mga pares ng pera (nakatuon sa pangunahing mga uri ng pera) |

| Saklaw sa iba't ibang senaryo | Hindi malinaw na impormasyon sa bayad |

Tunay ba ang MTFX ?

Ang MTFX ay hindi regulado, kahit na inaangkin ng MTFX na regulado ito ng FINTRAC (Financial Transactions and Reports Analysis Centre of Canada). May isyu sa regulasyon ang broker na ito, at inirerekomenda na pumili ang mga mangangalakal ng reguladong regulasyon.

Anong mga Serbisyo ang Ibinibigay ng MTFX ?

Ang pangunahing serbisyo na ibinibigay ng MTFX ay ang paglipat ng pondo sa pagitan ng mga bansa at serbisyong palitan ng pera, hindi tradisyonal na mga plataporma ng pagtetrading ng mga derivatives. Kasama dito ang:

Palitan ng Pera: Real-time na pag-convert ng 50+ mga uri ng pera, tulad ng pangunahing mga pares ng pera tulad ng CAD/USD at EUR/GBP.

Pagbabayad sa Pagitan ng mga Bansa: Personal na pagpapadala ng pera (mga bayad sa tuition, gastos sa pamumuhay, pondo para sa pagbili ng bahay) at mga korporasyon na bayad (pagtutuos sa supplier, sahod, koleksyon sa e-commerce).

Paghedging sa Panganib: Pagsasara ng mga rate ng palitan ng pera at mga estratehiya sa paghahedging na pasadya, angkop para sa internasyonal na kalakalan at senaryo ng pamumuhunan.

Uri ng Account

Nag-aalok ang MTFX ng dalawang uri ng account. Ang personal na account ay angkop para sa indibidwal na paglipat ng pera sa pagitan ng mga bansa, internasyonal na pagbabayad sa tuition, at regular na pagpapadala ng pera (tulad ng upa at pensyon), habang ang business account ay idinisenyo para sa korporasyon na paglipat ng pera sa pagitan ng mga bansa, pagtutuos sa supply chain, pamamahala ng pondo na may iba't ibang uri ng pera, at integrasyon sa plataporma ng e-commerce (tulad ng Amazon at eBay).

Platform ng Paggagalaw

Ang online portal ay sumusuporta sa 24/7 na mobile applications, kasama na ang iOS at Android apps.

Pagdedeposito at Pagwiwithdraw

Ang mga pondo ay direkta na ide-deposito sa bank account ng pinagbibigyan. Para sa korporasyon na paglipat ng pera, ang mga pondo ay darating sa loob ng 24-48 oras (pinapaboran ang mga wire transfer sa parehong araw). Karamihan sa personal na paglipat ng pera ay natatapos sa parehong araw o sa susunod na araw ng pagtatrabaho.