Profil perusahaan

| MTFX Ringkasan Ulasan | |

| Teregistrasi Pada | 2016-03-04 |

| Negara/Daerah Terdaftar | Kanada |

| Regulasi | Tidak Diatur |

| Layanan | Penukaran Mata Uang, Pembayaran lintas Batas, Lindung Nilai Risiko |

| Platform Perdagangan | MTFX (aplikasi iOS dan Android) |

| Dukungan Pelanggan | Facebook, Twitter, Instagram |

MTFX Informasi

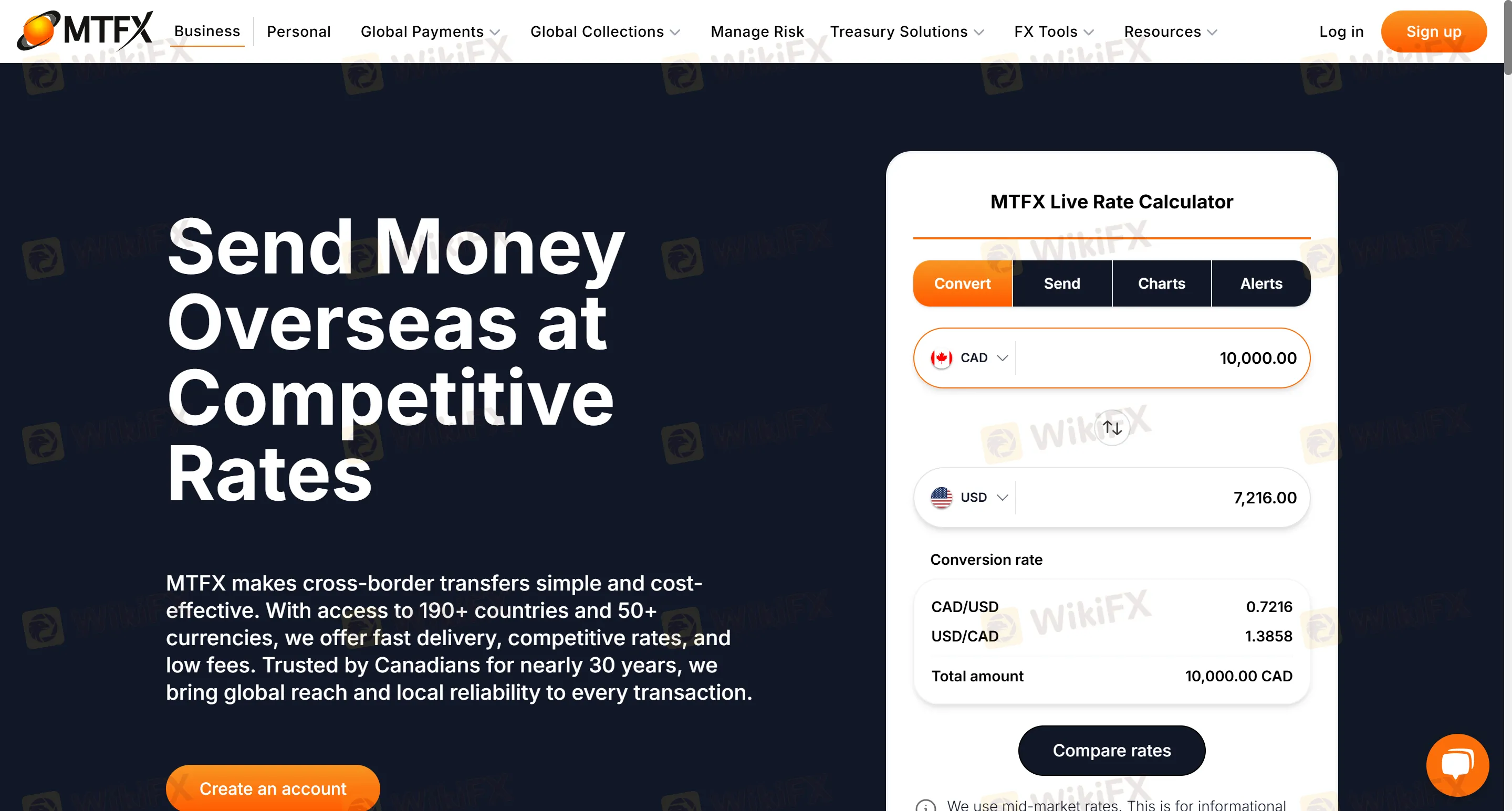

MTFX adalah platform yang sudah mapan yang mengkhususkan diri dalam pembayaran lintas batas, mendukung transfer lebih dari 50 mata uang ke lebih dari 190 negara. Ini menawarkan transfer lintas batas pribadi dan korporat, pengumpulan dana e-commerce, transfer dana bernilai tinggi (seperti pembelian properti luar negeri dan akuisisi barang mewah), manajemen akun multi-mata uang, dan lindung nilai risiko mata uang. Cocok untuk pengguna yang membutuhkan transfer lintas batas yang sering dan mengutamakan biaya kurs dan keamanan dana, terutama dalam pembayaran bernilai tinggi dan skenario korporat.

Pro dan Kontra

| Pro | Kontra |

| Kurs pertukaran 4% | Tidak Diatur |

| Akses 24/7 ke portal online | Pembatasan pada pasangan mata uang (berfokus pada mata uang utama) |

| Cakupan multi-skenario | Informasi biaya yang tidak jelas |

Apakah MTFX Legal?

MTFX tidak diatur, meskipun MTFX mengklaim diatur oleh FINTRAC (Pusat Analisis Transaksi Keuangan dan Laporan Kanada). Broker ini memiliki isu regulasi, dan disarankan agar para trader memprioritaskan memilih broker yang diatur.

Layanan Apa yang Disediakan oleh MTFX ?

MTFX terutama menyediakan transfer dana lintas batas dan layanan pertukaran mata uang, bukan platform perdagangan derivatif keuangan tradisional. Layanan termasuk:

Penukaran Mata Uang: Konversi real-time dari lebih dari 50 mata uang, seperti pasangan mata uang utama seperti CAD/USD dan EUR/GBP.

Pembayaran Lintas Batas: Pengiriman uang pribadi (biaya sekolah, biaya hidup, dana pembelian rumah) dan pembayaran korporat (penyelesaian pemasok, gaji, pengumpulan e-commerce).

Lindung Nilai Risiko: Mengunci kurs dan strategi lindung nilai yang disesuaikan, cocok untuk skenario perdagangan dan investasi internasional.

Jenis Akun

MTFX menawarkan dua jenis akun. Akun personal cocok untuk transfer lintas batas individu, pembayaran uang sekolah internasional, dan pengiriman reguler (seperti sewa dan pensiun), sementara akun bisnis dirancang untuk pembayaran lintas batas korporat, penyelesaian rantai pasokan, manajemen dana multi-mata uang, dan integrasi platform e-commerce (seperti Amazon dan eBay).

Platform Perdagangan

Portal online mendukung aplikasi seluler 24/7, termasuk aplikasi iOS dan Android.

Deposit dan Penarikan

Dana langsung ditransfer ke rekening bank penerima. Untuk transfer korporat, dana akan tiba dalam 24-48 jam (transfer kawat pada hari yang sama diprioritaskan). Sebagian besar transfer personal diselesaikan pada hari yang sama atau hari kerja berikutnya.