Présentation de l'entreprise

| MTFX Résumé de l'examen | |

| Inscrit le | 2016-03-04 |

| Pays/Région d'inscription | Canada |

| Régulation | Non réglementé |

| Services | Échange de devises, Paiements transfrontaliers, Couverture des risques |

| Plateforme de trading | MTFX (applications iOS et Android) |

| Support client | Facebook, Twitter, Instagram |

MTFX Informations

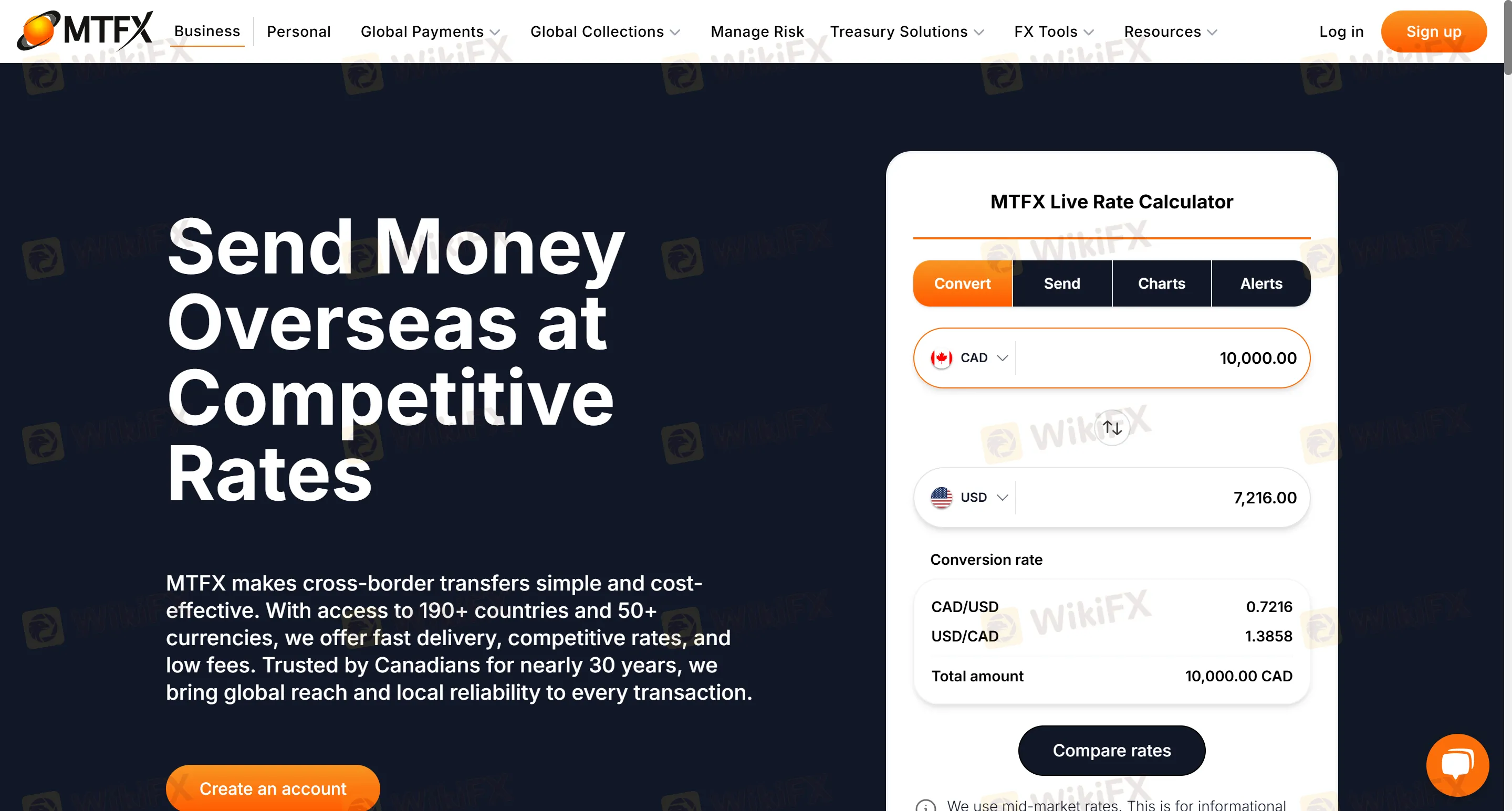

MTFX est une plateforme établie spécialisée dans les paiements transfrontaliers, prenant en charge le transfert de plus de 50 devises vers plus de 190 pays. Elle propose des transferts transfrontaliers personnels et d'entreprise, la collecte de fonds pour le commerce électronique, des transferts de fonds de grande valeur (comme les achats de biens immobiliers à l'étranger et l'acquisition d'articles de luxe), la gestion de comptes multi-devises et la couverture des risques de change. Elle convient aux utilisateurs ayant besoin de transferts transfrontaliers fréquents et attachant de l'importance aux coûts de change et à la sécurité des fonds, en particulier dans les paiements de grande valeur et les scénarios d'entreprise.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Taux de change de 4% | Non réglementé |

| Accès 24/7 au portail en ligne | Limitations sur les paires de devises (focus sur les principales devises) |

| Couverture multi-scénarios | Informations sur les frais peu claires |

Est-ce que MTFX est légitime ?

MTFX n'est pas réglementé, même si MTFX prétend être réglementé par le FINTRAC (Centre d'analyse des opérations et déclarations financières du Canada). Ce courtier présente des problèmes de réglementation, il est donc recommandé aux traders de privilégier le choix de courtiers réglementés.

Quels services MTFX propose-t-il ?

MTFX propose principalement des transferts de fonds transfrontaliers et des services de change, et non des plateformes de trading de produits dérivés financiers traditionnels. Les services comprennent :

Échange de devises : Conversion en temps réel de plus de 50 devises, telles que des paires de devises courantes comme CAD/USD et EUR/GBP.

Paiements transfrontaliers : Envois personnels (frais de scolarité, frais de subsistance, fonds pour l'achat d'une maison) et paiements d'entreprise (règlements de fournisseurs, paie, collecte de fonds pour le commerce électronique).

Couverture des risques : Verrouillage des taux de change et stratégies de couverture personnalisées, adaptées aux scénarios de commerce international et d'investissement.

Type de Compte

MTFX propose deux types de comptes. Les comptes personnels conviennent aux transferts transfrontaliers individuels, aux paiements de frais de scolarité internationaux et aux envois réguliers (comme le loyer et la pension), tandis que les comptes d'entreprise sont conçus pour les paiements transfrontaliers d'entreprise, les règlements de chaîne d'approvisionnement, la gestion de fonds multi-devises et l'intégration de plateformes de commerce électronique (comme Amazon et eBay).

Plateforme de Trading

Le portail en ligne prend en charge les applications mobiles 24/7, y compris les applications iOS et Android.

Dépôt et Retrait

Les fonds sont directement déposés sur le compte bancaire du bénéficiaire. Pour les transferts d'entreprise, les fonds arriveront dans un délai de 24 à 48 heures (les virements bancaires le jour même sont prioritaires). La plupart des transferts personnels sont effectués le jour même ou le jour ouvrable suivant.