公司簡介

| MTFX 檢討摘要 | |

| 註冊日期 | 2016-03-04 |

| 註冊國家/地區 | 加拿大 |

| 監管 | 未受監管 |

| 服務 | 貨幣兌換、跨境支付、風險對沖 |

| 交易平台 | MTFX (iOS 和 Android 應用程式) |

| 客戶支援 | Facebook、Twitter、Instagram |

MTFX 資訊

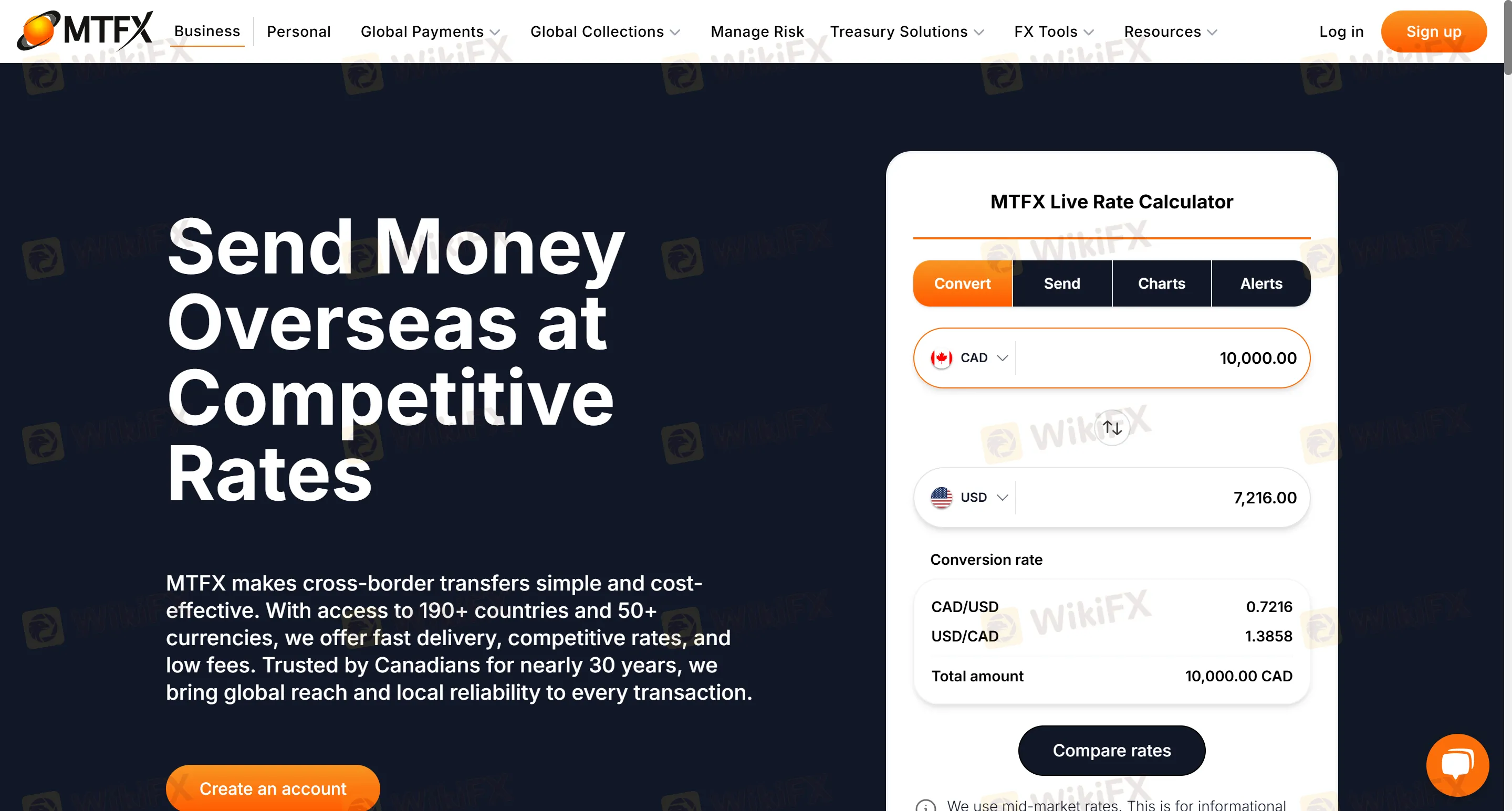

MTFX 是一個專門從事跨境支付的平台,支援將50多種貨幣轉移到超過190個國家。它提供個人和企業的跨境轉帳、電子商務資金收集、大額資金轉帳(如海外房地產購買和奢侈品收購)、多貨幣帳戶管理和貨幣風險對沖。適合需要頻繁跨境轉帳並重視匯率成本和資金安全的用戶,尤其是在大額支付和企業場景中。

優點和缺點

| 優點 | 缺點 |

| 4%的匯率 | 未受監管 |

| 全天候訪問在線門戶 | 貨幣對限制(專注於主要貨幣) |

| 多場景覆蓋 | 費用資訊不清晰 |

MTFX 是否合法?

MTFX 沒有受到監管,即使MTFX 聲稱受加拿大金融交易和報告分析中心(FINTRAC)監管。這家經紀商存在監管問題,建議交易者優先選擇受監管的經紀商。

MTFX 提供哪些服務?

MTFX 主要提供跨境資金轉帳和外匯服務,而不是傳統的金融衍生品交易平台。服務包括:

貨幣兌換:50多種貨幣的即時轉換,如主流貨幣對CAD/USD和EUR/GBP。

跨境支付:個人匯款(學費、生活費、購房資金)和企業支付(供應商結算、工資、電子商務收款)。

風險對沖:鎖定匯率和定制對沖策略,適用於國際貿易和投資場景。

帳戶類型

MTFX 提供兩種類型的帳戶。個人帳戶適用於個人跨境轉帳、國際學費支付和定期匯款(如租金和養老金),而企業帳戶則適用於企業跨境支付、供應鏈結算、多貨幣資金管理和電子商務平台整合(如亞馬遜和eBay)。

交易平台

在線門戶支持全天候的移動應用程式,包括iOS和Android應用程式。

存款和提款

資金直接存入收款人的銀行帳戶。對於企業轉帳,資金將在24-48小時內到帳(優先處理當天電匯轉帳)。大多數個人轉帳在當天或下一個工作日完成。