Perfil de la compañía

| MTFX Resumen de la reseña | |

| Registrado en | 2016-03-04 |

| País/Región de registro | Canadá |

| Regulación | No regulado |

| Servicios | Intercambio de divisas, Pagos transfronterizos, Cobertura de riesgos |

| Plataforma de trading | MTFX (aplicaciones iOS y Android) |

| Soporte al cliente | Facebook, Twitter, Instagram |

MTFX Información

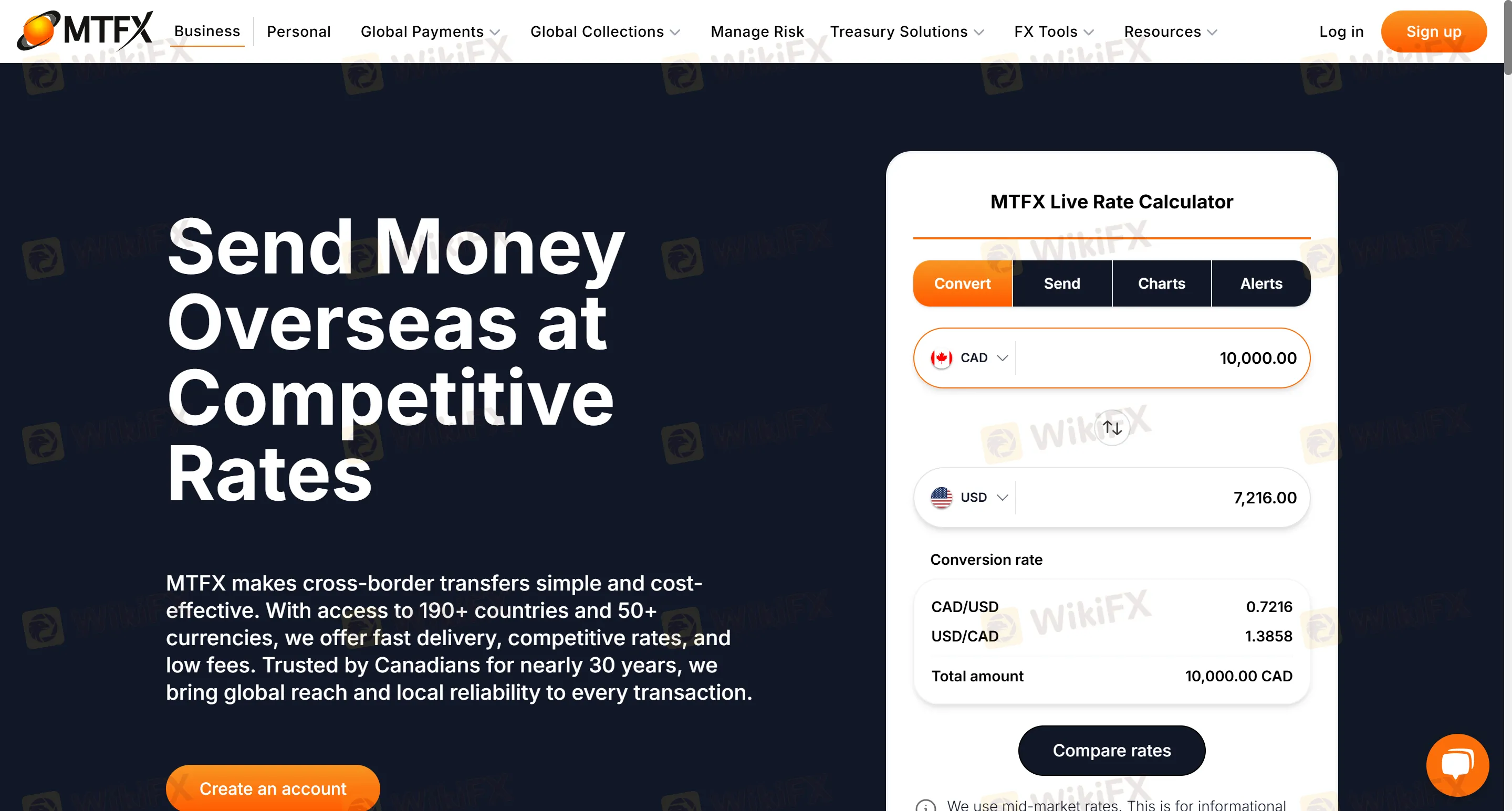

MTFX es una plataforma establecida especializada en pagos transfronterizos, que admite la transferencia de más de 50 monedas a más de 190 países. Ofrece transferencias transfronterizas personales y corporativas, recolección de fondos de comercio electrónico, transferencias de fondos de gran valor (como compras de propiedades en el extranjero y adquisiciones de artículos de lujo), gestión de cuentas en múltiples monedas y cobertura de riesgos cambiarios. Es adecuado para usuarios que necesitan transferencias transfronterizas frecuentes y dan importancia a los costos de cambio y la seguridad de los fondos, especialmente en pagos de gran valor y escenarios corporativos.

Pros y contras

| Pros | Contras |

| Tasa de cambio del 4% | No regulado |

| Acceso las 24 horas al portal en línea | Limitaciones en pares de divisas (enfoque en las principales monedas) |

| Cobertura en múltiples escenarios | Información de tarifas poco clara |

¿Es MTFX legítimo?

MTFX no está regulado, aunque MTFX afirma estar regulado por FINTRAC (Centro de Análisis de Transacciones Financieras y Reportes de Canadá). Este bróker tiene problemas regulatorios, y se recomienda que los traders prioricen la elección de brókers regulados.

¿Qué servicios ofrece MTFX ?

MTFX principalmente ofrece transferencias transfronterizas de fondos y servicios de cambio de divisas, no plataformas de trading de derivados financieros tradicionales. Los servicios incluyen:

Intercambio de divisas: Conversión en tiempo real de más de 50 monedas, como pares de divisas principales como CAD/USD y EUR/GBP.

Pagos transfronterizos: Remesas personales (tasas de matrícula, gastos de subsistencia, fondos para compra de vivienda) y pagos corporativos (liquidaciones de proveedores, nómina, cobros de comercio electrónico).

Cobertura de riesgos: Fijación de tasas de cambio y estrategias de cobertura personalizadas, adecuadas para escenarios de comercio e inversión internacionales.

Tipo de cuenta

MTFX ofrece dos tipos de cuentas. Las cuentas personales son adecuadas para transferencias transfronterizas individuales, pagos de matrícula internacionales y remesas regulares (como alquiler y pensión), mientras que las cuentas comerciales están diseñadas para pagos corporativos transfronterizos, liquidaciones de cadenas de suministro, gestión de fondos en múltiples monedas e integración con plataformas de comercio electrónico (como Amazon y eBay).

Plataforma de trading

El portal en línea admite aplicaciones móviles las 24 horas del día, los 7 días de la semana, incluidas las aplicaciones iOS y Android.

Depósito y retiro

Los fondos se depositan directamente en la cuenta bancaria del beneficiario. Para transferencias corporativas, los fondos llegarán en un plazo de 24 a 48 horas (se priorizan las transferencias bancarias del mismo día). La mayoría de las transferencias personales se completan el mismo día o al día hábil siguiente.